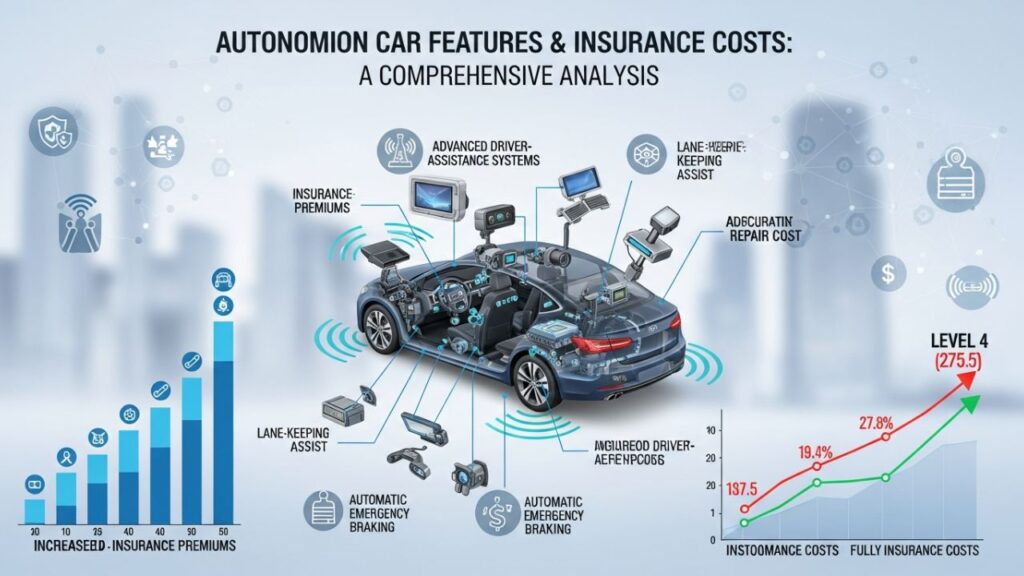

Autonomous car features, from basic ADAS like lane-keeping assist to full self-driving systems, are reshaping insurance landscapes by reducing human-error accidents and potentially lowering premiums by 10-50%. In 2025, as vehicles reach SAE Levels 2-4, insurers offer tiered discounts, but complex liabilities and high repair costs can offset savings.

This shift promises safer roads—autonomous tech could cut crashes 90%—yet requires new policies for AI-driven risks. In India, where EVs and autonomy converge, premiums may drop 15-20% for equipped cars amid regulatory evolution. Understanding these dynamics helps drivers optimize coverage.

Introduction to Autonomous Driving Features

Autonomous driving encompasses a spectrum of technologies, classified by SAE levels from 0 (no automation) to 5 (full autonomy). Level 1 offers basic aids like adaptive cruise control; Level 2, partial automation with driver supervision, such as Tesla’s Autopilot. Level 3 allows conditional hands-off driving in specific scenarios, like highway merging.

In 2025, over 70% of new cars feature Level 2 ADAS, per McKinsey, integrating sensors, cameras, and AI for real-time decisions. These systems process 4TB of data per hour, preventing collisions via predictive algorithms. Globally, adoption surges in the U.S. and EU, while India’s FAME scheme incentivizes ADAS in EVs like Tata’s models.

Insurance implications stem from risk redistribution: human liability fades as machines take control, altering premium calculations. Insurers now use telematics to verify feature usage, rewarding safe operations with discounts. However, cybersecurity vulnerabilities introduce new perils.

Read Also: Zero Down Payment Car Loans – Is It Worth It in 2025?

SAE Levels of Autonomy and Their Insurance Ties

SAE Level 0-1 vehicles mirror traditional insurance, with premiums based on driver history—average $1,200 annually in the U.S. Level 2 features, like lane centering, correlate with 10-20% lower claims, yielding 5-10% discounts from providers like Progressive.

Level 3 autonomy, emerging in 2025 models from Mercedes and BMW, shifts partial liability to manufacturers, potentially reducing personal premiums by 15% but raising product coverage needs. Insurers like Allianz test hybrid policies distinguishing manual vs. autonomous modes.

Full Level 4-5, seen in Waymo fleets, could slash per-mile costs 50% by 2040, per Goldman Sachs, as accidents drop 94%. Yet, initial premiums may rise 20-30% due to $50,000+ sensor repairs. In India, IRDAI is adapting frameworks for Level 3, eyeing 20% market penetration by 2030.

Telematics verifies level usage: Level 2+ engagement logged via black boxes qualifies for UBI discounts up to 40%, as in Tesla’s Safety Score program.

How ADAS Features Lower or Raise Premiums

Advanced Driver Assistance Systems (ADAS), including automatic emergency braking and blind-spot monitoring, directly influence premiums by mitigating risks. Studies show ADAS reduces collisions 27-50%, prompting insurers like Swiss Re to offer 5-15% discounts based on feature scores.

For instance, AEB alone cuts rear-end crashes 50%, saving $500-1,000 yearly on U.S. policies. In India, HDFC Ergo provides 10% off for cars with AEB, aligning with rising ADAS adoption in mid-range vehicles. Usage-based models track activation, with high-engagement drivers seeing 20% savings.

Conversely, premiums can rise if features fail: a Level 2 glitch in a 2024 Tesla incident led to denied claims, hiking rates 15% for owners. High-tech repairs—$15,000 for lidar replacement—elevate base costs, offsetting discounts by 10-20%.

Insurers mitigate via tiered credits: 5% for Level 1, 10% for Level 2, per Zigpoll frameworks, encouraging upgrades. Data-driven pricing, using 95% accurate telematics, personalizes rates further.

Liability Shifts in Autonomous Vehicles

Traditional insurance pins liability on drivers; autonomy transfers it to OEMs and software firms for Level 3+. In crashes, AI decisions—e.g., evasive maneuvers—could make manufacturers liable, as in a 2025 EU ruling against Volkswagen’s system. Personal policies shrink, with premiums potentially halving by 2040.

In India, the Motor Vehicles Act still holds owners responsible, but 2025 amendments propose shared models, reducing individual costs 15-25% for autonomous EVs. Commercial fleets, like Uber’s AV pilots, need $5M coverage, raising operator premiums 30% initially.

Ethical dilemmas, like AI prioritizing passengers, complicate claims, necessitating cyber liability add-ons at $200-500 yearly. Insurers like Zurich bundle product and general liability, smoothing transitions.

Hybrid policies cover both modes, with mode-specific deductibles—lower for autonomous. Globally, 60% of insurers plan liability shifts by 2027.

Premium Discounts and Pricing Models

Autonomous features unlock usage-based insurance (UBI), where premiums tie to data like miles in self-driving mode. Level 2 users average 10-20% discounts; Level 3+, up to 40% via safety scores. Tesla’s program rewards 98% scores with 30% off.

In 2025, dynamic UBI adjusts monthly—e.g., 15% lower for 80% autonomous highway use. Indian insurers like Jio Broking offer 10-15% for ADAS-equipped EVs, using telematics for verification. Pay-per-mile models suit fleets, cutting costs 25% for low-utilization.

Challenges include data privacy: 81% of drivers hesitate sharing, per S&P Global, potentially limiting discounts. Bundled OEM insurance, like GM’s OnStar, integrates AV coverage at 20% below market.

Tiered structures—5% for basic ADAS, 20% for full—boost adoption, with ROI via 30% fewer claims.

Repair Costs and Their Impact on Insurance

Autonomous vehicles inflate repair bills: a fender-bender now costs $10,000-30,000 for sensor calibration, versus $2,000 traditionally. Lidar and radar replacements hit $20,000, raising comprehensive premiums 15-25%.

In India, EV autonomy adds 20% to parts costs, with Tata models seeing ₹1-2 lakh fixes. Insurers pass this via higher deductibles or sub-limits on tech components. However, fewer accidents—down 40% with ADAS—balance long-term savings.

Predictive maintenance via AI cuts claims 20%, as Mobileye systems flag issues early. Specialized shops, scarce in rural India, extend downtime, adding rental coverage needs at $50/day.

By 2030, repair costs may stabilize with modular designs, but 2025 hikes premiums 10% overall.

Emerging Risks and Higher Costs

Cybersecurity tops risks: AV hacks could cause mass incidents, prompting $500-1,000 cyber add-ons. A 2024 ransomware on Waymo fleet cost $2M, spiking commercial rates 25%.

Ethical AI decisions and sensor failures introduce “black swan” events, with premiums rising 20% for early adopters. In India, congested roads amplify disengagement risks, where humans must intervene—potentially voiding discounts if untrained.

Regulatory patchwork: U.S. states like Arizona mandate $1M coverage, inflating costs 30%. India’s lag adds uncertainty, with IRDAI piloting AV insurance.

Insurers counter with fraud detection—AI verifies claims, reducing invalid ones 50%. Yet, short-term premiums climb as models adapt.

Insurance Trends in India for Autonomous Cars

India’s AV market, projected at 10% penetration by 2030, sees insurers like HDFC Ergo offering 10-20% ADAS discounts amid EV growth. Jio Broking’s digital UBI uses app data for real-time pricing, saving urban drivers 15%.

Challenges include infrastructure: potholes damage sensors, raising repairs 25%. Regulatory shifts under Motor Vehicles Amendment Bill aim for OEM liability, potentially halving personal premiums.

Telematics adoption hits 40% in metros, with Bajaj Allianz bundling AV coverage for fleets. Subsidies under FAME-III make equipped EVs affordable, boosting insurance uptake.

Future: By 2027, 25% premium drop for Level 3, per IRDAI forecasts, transforming affordability.

Read Also: Tesla China Deliveries October 2025: Model Y Sales Hit Record Low, Exports Surge

Global Perspectives and Case Studies

In the U.S., Waymo’s Phoenix fleet reduced accidents 70%, leading to 20% lower fleet premiums but $5M liability mandates. A 2025 Florida pilot showed Level 4 rideshares cutting claims 50%, yet cyber claims rose 15%.

EU’s Zurich trials in Germany yielded 18% savings for ADAS users, with product liability shifting 60% to manufacturers. India’s Chennai AV test with Tata logged 30% fewer incidents, earning 12% discounts from ICICI Lombard.

Tesla’s global Safety Score program saved users $1,000 average, but a UK glitch case hiked rates 25%. These highlight balanced impacts: savings for safe use, costs for complexities.

Future of Insurance for Autonomous Vehicles

By 2030, premiums could fall 40-60% as autonomy dominates, per S&P, with manufacturer-borne liabilities. On-demand models for shared AVs emerge, priced per trip at $0.10/mile.

In India, AI-integrated policies predict risks, cutting fraud 40%. Blockchain for claims verifies autonomy data, speeding payouts 70%.

Challenges: Equity—rural access lags—may widen gaps. Insurers like Allianz foresee $200B market disruption, favoring adaptable firms.

Optimism prevails: Safer roads mean lower costs, with 80% consumer acceptance by 2028.

Conclusion

Autonomous features generally lower insurance costs through risk reduction and discounts, though repair and liability complexities temper gains. In 2025, savvy drivers can save 10-40% by opting for verified ADAS and UBI, paving the way for affordable, safer mobility. As tech evolves, insurance will adapt, benefiting all stakeholders.