Buying a car is one of the biggest financial commitments for most individuals. Whether you’re opting for a budget-friendly hatchback, a stylish sedan, or a feature-loaded SUV, smart financial planning is essential. One of the most powerful tools in your financial toolkit is the Car Loan EMI Calculator.

In 2025, car prices, interest rates, and financing options continue to evolve. Banks and finance companies offer a wide range of car loan products, but choosing the right EMI and loan structure is what determines your long-term financial comfort.

An EMI calculator helps you understand your monthly commitment, compare lenders, plan repayment schedules, and avoid financial stress. It turns complex numbers into simple insights, helping you make smarter decisions.

This guide explains everything you need to know about car loan EMI calculators—how they work, why they matter, and how to use them like a pro.

What Is a Car Loan EMI Calculator?

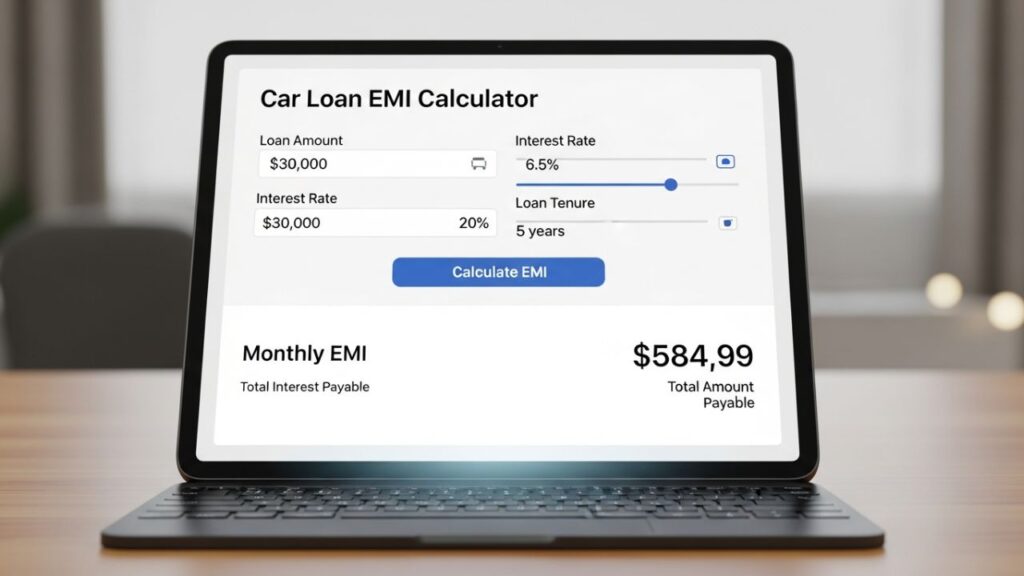

A Car Loan EMI Calculator is an online tool that instantly computes the monthly installment (EMI) you will need to pay for a car loan based on:

- Loan amount

- Loan tenure

- Interest rate

- Processing fees (optional in some calculators)

With just a few inputs, the tool gives you:

- Your exact monthly EMI

- Total interest payable

- Total amount payable over the entire tenure

- A repayment schedule breakdown (amortization chart)

This eliminates guesswork and helps compare multiple loan options quickly.

Read Also: Tesla China Deliveries October 2025: Model Y Sales Hit Record Low, Exports Surge

Why You Need a Car Loan EMI Calculator

Here are the most important reasons why every car buyer—first-timer or experienced—should use an EMI calculator:

1. Helps You Choose the Right EMI

Choosing the correct EMI amount is crucial. Too high, and your monthly budget becomes stressed. Too low, and the total interest becomes excessively high.

The EMI calculator helps you strike the perfect balance.

2. Avoids Over-Borrowing

The tool clearly shows whether your income can comfortably handle the EMI. It helps prevent mistakes like:

- Taking a loan larger than your repayment capacity

- Stretching tenure unnecessarily

- Choosing expensive models outside your practical budget

3. Accurate, Instant Calculations

Manual EMI calculation is difficult. Researchers, bankers, and finance experts rely on formulas—but for you, a calculator removes all the complexity.

One click = instant and accurate EMI.

4. Compare Multiple Loan Offers Easily

With rising competition among lenders, interest rates vary significantly. Using an EMI calculator, you can instantly compare:

- Bank A (10% interest)

- Bank B (9.5% interest)

- Bank C (11% interest)

A small change of 0.5% can lead to substantial savings over time.

5. Helps You Decide Between Shorter and Longer Tenures

Should you pick 3 years or 7 years?

The EMI calculator shows:

- Short tenure → higher EMI but lower total interest

- Long tenure → lower EMI but higher total interest

This data helps you align your loan with your long-term goals.

6. Essential for Pre-Owned Car Loans

Used car loans often come with higher interest rates. The calculator helps understand if the EMI is worth it for the vehicle’s age and value.

7. Prevents Hidden Cost Surprises

By comparing multiple EMI results, you can identify:

- High processing fees

- High interest rates

- High insurance add-ons

Making you a smarter borrower.

Understanding the EMI Formula (Simplified)

EMI is calculated using the formula:

EMI=P×R×(1+R)N(1+R)N−1EMI = \frac{P \times R \times (1+R)^N}{(1+R)^N – 1}EMI=(1+R)N−1P×R×(1+R)N

Where:

- P = Principal (Loan Amount)

- R = Monthly Interest Rate (Annual Rate/12)

- N = Loan tenure in months

Though the formula looks complex, an EMI calculator simplifies everything to one click.

How a Car Loan EMI Calculator Works (Step-by-Step)

Here’s exactly what happens when you use an EMI calculator:

Step 1: Enter Loan Amount

This is the total amount you want to borrow after:

- Down payment

- Trade-in value

- Discount or offer from dealership

Example:

If car price = ₹10,00,000

Down payment = ₹2,00,000

Loan amount = ₹8,00,000

Step 2: Select Loan Tenure

Tenures range between 12–84 months.

Typically:

- Shorter tenure = higher EMI

- Longer tenure = lower EMI

Step 3: Enter Interest Rate

Banks use fixed or floating interest rates.

Example:

- Fixed rate = predictable EMIs

- Floating rate = may change with market conditions

Step 4: Calculate EMI

Click “Submit” or “Calculate”.

The calculator instantly shows:

- Monthly EMI

- Total Interest Payable

- Total Amount Payable

- Amortization Table

Step 5: Compare and Adjust

You can modify:

- Loan amount

- Tenure

- Rate

This helps create the perfect EMI strategy.

Example: Sample EMI Calculation (Practical Illustration)

Car Price: ₹12,00,000

Down Payment: ₹2,00,000

Loan Amount: ₹10,00,000

Tenure: 5 years (60 months)

Interest Rate: 10% per annum

Result from calculator:

- EMI = approx. ₹21,248

- Total Interest Payable = ₹2,74,908

- Total Amount Payable = ₹12,74,908

Interpretation:

- You pay nearly ₹2.75 lakhs in interest.

- Adjusting tenure or down payment can change the numbers drastically.

Amortization Schedule: Why It Matters

An amortization table shows how much of your EMI goes to:

- Principal Repayment

- Interest Amount

At the beginning:

- Most of your EMI goes towards interest.

Towards the end:

- Most of your EMI goes towards principal.

This helps you plan:

- Prepayment timing

- Balance comparison

- Early closure strategies

How to Use EMI Calculator for Smarter Repayment Planning

Here are expert-backed strategies:

1. Try Different Tenure Options

Change the tenure and observe:

- EMI difference

- Total interest difference

For example:

| Tenure | EMI | Total Interest |

| 3 years | High | Low |

| 5 years | Medium | High |

| 7 years | Lowest | Highest |

Choose wisely based on budget and goals.

2. Adjust Down Payment for Savings

Increasing down payment reduces:

- EMI

- Interest

- Loan amount

- Financial stress

Higher down payment = better loan terms.

3. Compare Interest Rates

Use the calculator to simulate different bank offers.

A change from:

- 10% to 9% can save you nearly ₹50,000+ over 5 years.

4. Evaluate Prepayment Benefits

Use the calculator to test:

- Prepaying ₹50,000

- Prepaying ₹1,00,000

This helps reveal:

- How much interest you save

- How your tenure reduces

- Whether foreclosure is worth it

5. Simulate Used vs New Car Financing

A calculator helps check if a used car loan is worth it by analyzing:

- Higher interest

- Shorter tenure

- Lower car value

6. Plan Budget Before Going to the Dealership

Avoid emotional overspending.

Calculate EMI first and choose a car that fits the EMI—not vice versa.

Factors Affecting Your EMI

1. Loan Amount

Higher loan = higher EMI.

2. Interest Rate

The single biggest EMI influencer.

3. Loan Tenure

Longer tenure = lower EMI but higher overall cost.

4. Down Payment

Higher down payment = lower EMI.

5. Credit Score

Credit score influences interest rate.

Better score = lower EMI.

6. Car Type

Banks offer better interest rates for:

- New cars

- Premium models

- Electric vehicles

Car Loan EMI Planning for Different Budgets

1. Low-Budget Buyers (Under ₹10 Lakhs)

Tips:

- Choose a shorter tenure

- Try for 20–30% down payment

- Compare used vs new

Goal: Keep EMI below 20–25% of monthly salary.

2. Mid-Budget Buyers (₹10–25 Lakhs)

Tips:

- Consider 5-year tenure

- Avoid unnecessary dealer add-ons

- Evaluate EV options for lower running costs

Keep EMI within 25–30% of net monthly income.

3. Premium and Luxury Buyers (₹25–60 Lakhs)

Tips:

- Always compare interest rates

- Choose higher down payment

- Consider balloon payment loans if allowed

Keep EMI below 35–40% of monthly income.

Why Car Loan EMI Calculator Is Essential for First-Time Buyers

- Helps pick the right car

- Prevents accidental overspending

- Reduces anxiety

- Improves negotiation power

- Helps achieve a healthy financial lifestyle

Read Also: Cheap Car Insurance for New Drivers in U.S

Common Mistakes to Avoid When Using EMI Calculators

❌ Using only one lender’s calculator

Always compare at least 3–5 lenders.

❌ Ignoring processing fees

These can affect overall loan cost.

❌ Choosing longest tenure by default

This increases interest burden significantly.

❌ Not accounting for insurance and registration cost

Your budget must include ALL charges.

❌ Not checking credit score before calculating

Interest rate depends on score.

Frequently Asked Questions (FAQ)

1. Is the EMI shown by the calculator 100% accurate?

Yes, for standard fixed-rate loans, it is accurate.

2. Does EMI include insurance and registration?

No, EMI includes only the loan components.

3. Can EMI change after a loan starts?

Only if interest rate is floating.

4. Can I reduce EMI during the loan?

Yes, by:

- Prepaying

- Reducing interest rate via refinance

- Changing tenure (with lender approval)

5. Is higher down payment always better?

Generally yes—it reduces EMI and interest significantly.

Conclusion

A Car Loan EMI Calculator is one of the most powerful financial tools available to car buyers in 2025. It simplifies complex loan maths, helps you plan repayments smartly, ensures you don’t overspend, and allows easy comparison across lenders.

Whether you’re a first-time car buyer or upgrading to a new model, using an EMI calculator ensures that you’re making a logical, well-planned, and stress-free financial decision.

Smart EMI planning = stress-free car ownership.